When so many Northern Michiganders and Upper Peninsula residents are struggling to make ends meet, it's imperative we lift up working families.

WASHINGTON, D.C. — The Child Tax Credit was expanded by the American Rescue Plan Act of 2021 lifting at least 117,000 children out of poverty across the state. This historic investment in working families and children was supported by voters across the political spectrum.

The previous credit of $2,000 per child was expanded to $3,000 per child ($3,600 for children under six). New provisions extend this to 2025 but my opponent, Jack Bergman, doesn’t support it. This extension will benefit 1,968,000 children in Michigan including 229,000 children who are considered poor, reducing child poverty in Michigan — and in the Nation — nearly in half.

This child tax credit extension is noble and just, accomplished without substantially raising the national debt. Some analyses say it's cost-neutral or possibly revenue-generating.

When so many Northern Michiganders and Upper Peninsula residents are struggling to make ends meet, it's imperative we lift up working families. Why doesn’t Jack see it this way?

Supporting tax cuts to wealthy corporations, but opposing tax credits for working families? Not supporting efforts to reduce childhood poverty? His opposition baffled me until I understood that Jack answers to large corporations who donate to his campaign rather than serving the great people of this district.

The most significant obstacle we face in creating a better future for this district is Jack Bergman. Children and families in our district deserve better.

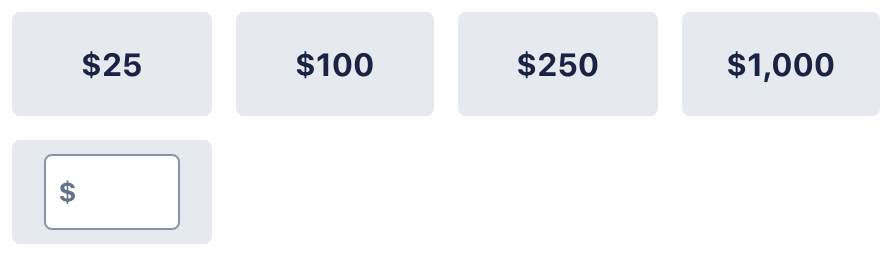

Pitch in now and help get me to Washington so we can have someone willing to fight for working families of Northern Michigan and the Upper Peninsula.

– Dr. Bob

Comments