What was once Republican-led dream legislation in 1997 is now mislabeled socialism. Back then, it was passed with overwhelming bipartisan support.

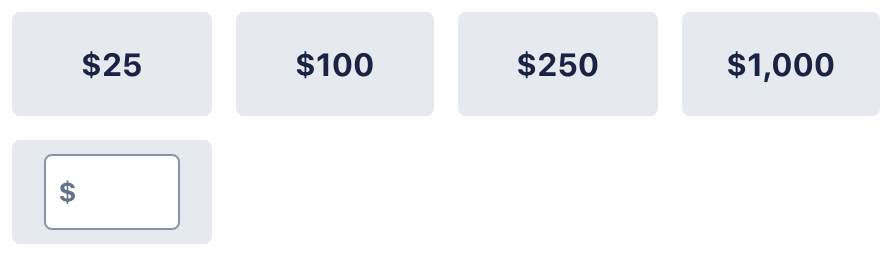

The Dr. Bob Lorinser for Congress campaign is 100% funded by individual donors. With a deadline in 8 days, Dr. Bob is up against corporate PACS and dark money. We need you. Can you pitch in and make a contribution today?

GWINN, Mich. – Recently, we produced a piece outlining the debilitating cost of childcare for Northern Michigan, UP families. Our district's average cost of childcare is over $700 per child per month – sometimes costing parents half their monthly salary. Several childcare provisions in the Build Back Better (BBB) Framework would reduce this burden on families.

Unfortunately, there are many misconceptions about the Child Tax Credit. We hope to replace the current hyperbole and divisive political rhetoric as we briefly review its initial purpose and history.

Purpose of the Child Tax Credit (CTC)

The Child Tax Credit (CTC) is a Federal benefit that reduces income tax liability for Americans with children. It was created in 1997 and has expanded several times. The CTC's purpose is to help working families offset the cost of raising children. The program is intended to help low- to middle-income taxpayers, and it's phased out for high-income families. The credit is meant to support working families and ease the tax burden of overwhelmed parents. For the lowest in income bracket, it's a proven way to keep working families off welfare.

History of the CTC

The CTC was started by Republicans in 1997 and met amendments several times over 20 years by both parties.

The Child Tax Credit was first created in 1997 under Republican-sponsored legislation. President Clinton (D) signed the Taxpayer Relief Act into law.

The CTC was established as a non-refundable $400 credit for children under age 17

It passed with overwhelmingly bipartisan support in the House and Senate. Northern Michigan and the Upper Peninsula’s Congressman, Rep. Bart Stupak, voted Yea, as did every Michigan House Republican.

The debate around it hinged on whether or not to offer it only to income-tax payers or to payroll tax-payers as well, the latter referring to the working poor.

The program was amended in 2001 in the passage of the Economic Growth and Tax Relief Reconciliation Act signed into law by President George W. Bush (R).

The credit increased the amount of the credit to $1,000 per child and made it partially refundable.

Republicans passed it with partisan support (House 230-197 & Senate 62-38).

The CTC was amended in 2012 in the passage of the 2012 American Taxpayer Relief Act signed into law by President Barack Obama (D).

The bill made the $1,000 per child credit fully refundable.

A Republican-controlled House (256-171) and Democratic-controlled Senate (89-8) passed the act.

The credit was amended in 2017 in the passage of the 2017 Tax Cut and Job Act signed into law by President Trump (R).

Congress increased the credit to $2,000 with a refundable limit of $1,400.

Republicans passed the act with support in both the House (227-205) and Senate (52-49),

The Child Tax Credit was amended in 2021 in the passage of the American Rescue Plan Act signed into law by President Biden (D).

It increased from $2,000 to $3,600 for those under six and $3,000 for those six to age 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent.

The bill passed with Democrat support in the House (219-212) and Senate (50-49).

The latest changes to the CTC found in the American Rescue Plan are only temporary and set to expire at the end of this year. The Build Back Better Framework would extend this benefit one additional year, and I support this provision as written.

The Child Tax Credit is a relief for families raising children in the current 21st-century economy. Our government recognizes that those who need relief are everyday American people, the middle class, and below. It is right and just. The Center on Budget and Policy Priorities says the benefits of expanding CTC outweigh minor employment effects, stating more than 99% of low- and moderate-income working adults affected by the proposal would remain employed after it takes effect.

Legislators need to ask how we support our families after the CTC expires. A debate based on the facts is critical. The credit is a meaningful way to help families, and its principle (tax-cuts) transcends both parties. If this is not the solution, what’s the better plan?

Some prominent members of Congress are calling the Child Tax Credit “socialism,” possibly not knowing its history and falling back on taglines. We must debate this issue by avoiding worthless rhetoric and false labels. I am interested in addressing the issue at hand with a strong understanding of all its complexities.

Like many Republicans and Democrats before me, I support the Child Tax Credit and what it has done for America and our families. I’m always interested in improvements and new solutions, so when a new plan is worth considering, and when I’m so honored to serve as Northern Michigan and the Upper Peninsula’s next Congressman, I will be at the negotiation table.

I will advocate on your behalf and ensure relief continues to support hard-working American families.

The Dr. Bob Lorinser for Congress campaign is 100% funded by individual donors. With a deadline in 8 days, Dr. Bob is up against corporate PACS and dark money. We need you. Can you pitch in and make a contribution today?

Dr. Bob Lorinser | Bob Lorinser | Michigan | Northern Michigan | Upper Peninsula | Jack Bergman | Michigan's First District | Congress | United States Representative Congress | Dr. Bob | Dr. Lorinser |